As you may already be aware, 60 of the world’s largest commercial and investment banks collectively invested $3.8 trillion into fossil fuels from 2016 to 2020, and “fossil fuel financing …was higher in 2020 than it was in 2016,”

What’s this got to do with you? Well, quite a lot. Here’s why, and what you can do about sustainable finance decisions:

What is ‘sustainable finance’?

It’s taking into account the impact that investment decisions have on the environment, society, and how the decisions are mutually dependent on the governance of public and private institutions. These considerations are known collectively as ESG.

My bank’s not on that list, so I’m good?

Well, this report talks about investing. There’s still the question of all the assets (businesses, plants, machinery) related to fossil fuels. They’ve become very unfashionable, so the companies that own them want either to sell them, or to hide them.

Introducing fossil fuel ‘‘bad banks”. The term ‘bad bank’ started after the 2008 financial crisis, when big banks wanted to get rid of their toxic assets. So they created separate entities, called SPVs, and moved their high-risk assets there. Just like if you were expecting a guest to visit, and instead of cleaning up all the old takeaway boxes and dirty plates, you just put up the tent in the garden, and move the rubbish in there.

A recent high profile example of one of these dirty bank tents is Coal to Zero. What do you want first, the good news, or the bad news? Good news: The world’s largest asset manager, the appropriately named BlackRock, teamed up with Citigroup and Trafigura (commodity trading) to propose a vehicle (tent) that will buy up coal mines and run them for a profit. The good news? Potential investors said ‘No, nuh-uh, no way’ so the idea was shelved. Investors decided not to buy into what would, admittedly, be a profitable, if short-lived (no pun intended) venture. The bad news? Well, if you’re interested, have a look at the new and exciting fun that JPMorgan Chase, Citigroup and BlackRock are cooking up these days.

So what’s all this got to do with me?

Well, you’ve got money haven’t you? And assets, and, probably investments and a pension too. Where do they come from, and where are they being used? Yes, don’t forget your pension – after all, what use is a pension if you have no planet to retire on?

You are somewhere in the cycle: the buyer, the seller, the owner, the manager, of money.

Wherever you are, you’re a decision-maker. The decision of how your capital, your energy, is used, lies with you.

Here are some tips on what you can do:

- Educate yourself on where your capital is, and how it’s being used.

- Consider ecologically-minded institutions:

For your banking: (UK) Triodos, Nationwide, Monzo and Starling (US) Aspiration, City First Bank, Amalgamated Bank

For your investments: Impact investments, which specifically aim to have a positive impact on the world. Intermediary platforms such as Nutmeg and Hargreaves Lansdown allow small-scale investors to align their money with their own priorities, while sites like Ethex and Tickr specifically channel investments into companies trying to make a positive difference.

For your pension, a bit trickier. More legislation on transparency needs to be added here, but this is an interesting article to get you started.

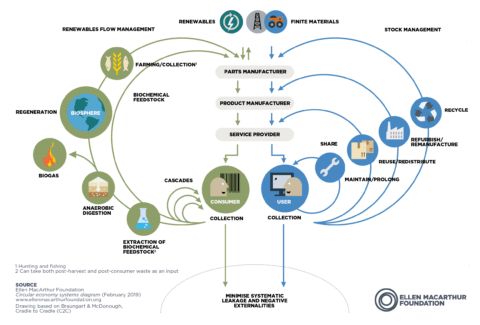

And lastly, to circle back to the first point – (heard of the circular economy?):

While educating yourself, try to get as much variety as possible in the sources of information. When you get a quote for a building job, or a medical opinion, you don’t just get one right? Right. And to have access to a variety of information, you need the language to understand it. Let’s be honest, sorry, the majority of information, especially about financial services, is in English. We can help. Have a look at Capricorn’s Financial English suite of modules, and give us a call.

Until then-

Let’s clean this place up!